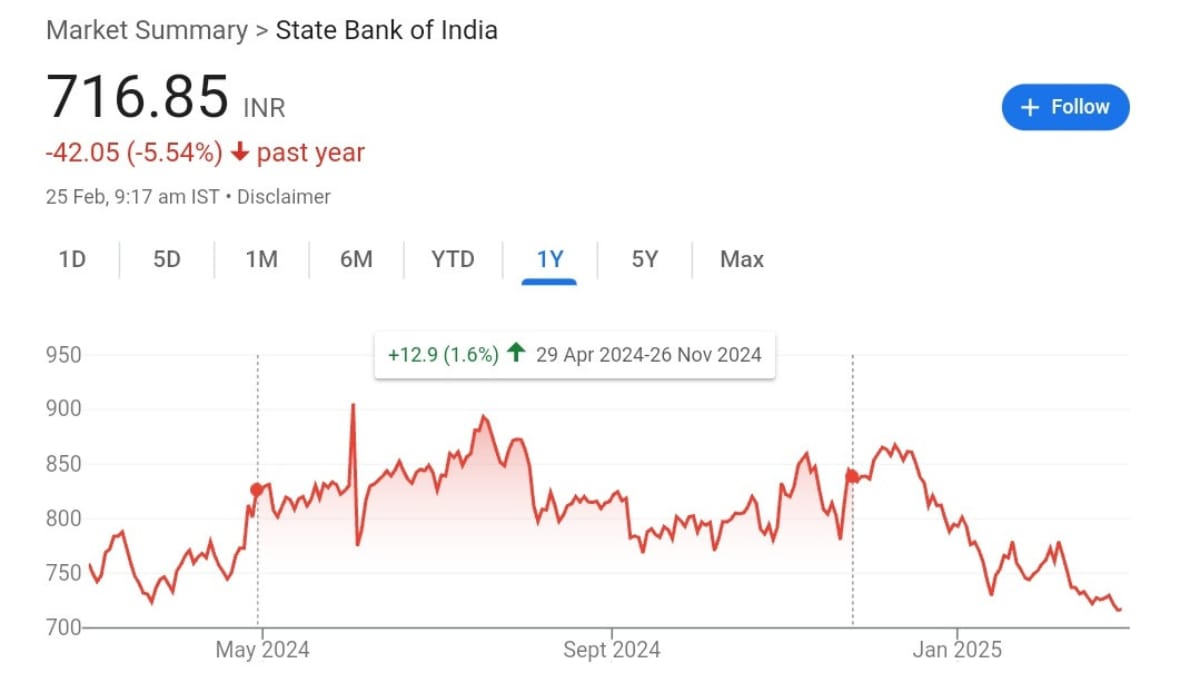

SBI Bank Share Price Target 2025-The State Bank of India (SBI), India’s largest public sector bank, holds a significant position in the financial landscape. In 2025, the bank is expected to witness steady growth, driven by factors such as the country’s economic recovery, rising credit demand, and increased digital banking penetration. As of 25 February 2025, SBI’s share price on the National Stock Exchange (NSE) stands at ₹716.20.

State Bank Of India – Current Market Overview

- Open Price: ₹727.30

- Day’s High: ₹731.70

- Day’s Low: ₹720.00

- Market Capitalization: ₹6.43 Lakh Crore

- P/E Ratio: 8.10

- Dividend Yield: 1.90%

- 52-Week High: ₹912.00

- 52-Week Low: ₹711.55

Current Share Price Charts and Market Statistics

SBI’s consistent performance reflects its strong fundamentals and government backing. With solid retail lending operations and expanding digital services, SBI is preferred for investors seeking long-term gains.

Recent Performance Trends

In recent months, SBI shares have experienced moderate fluctuations, staying within a healthy range. This stability can be attributed to the bank’s robust financial health and increasing investor confidence.

SBI Bank Share Price Prediction for 2025

Month-Wise Price Forecast

| Sbi Bank Share Price Target Years | Sbi Bank Share Price Target Months | Share Price Target |

| Sbi Bank Share Price Target 2025 | January | – |

| Sbi Bank Share Price Target 2025 | February | ₹735 |

| Sbi Bank Share Price Target 2025 | March | ₹750 |

| Sbi Bank Share Price Target 2025 | April | ₹770 |

| Sbi Bank Share Price Target 2025 | May | ₹790 |

| Sbi Bank Share Price Target 2025 | June | ₹810 |

| Sbi Bank Share Price Target 2025 | July | ₹830 |

| Sbi Bank Share Price Target 2025 | August | ₹850 |

| Sbi Bank Share Price Target 2025 | September | ₹870 |

| Sbi Bank Share Price Target 2025 | October | ₹890 |

| Sbi Bank Share Price Target 2025 | November | ₹900 |

| Sbi Bank Share Price Target 2025 | December | ₹920 |

Expected Growth Trends

The share price is projected to rise steadily, driven by higher loan demand, government reforms, and advancements in digital banking. By the end of 2025, the stock could potentially reach around ₹920 if market conditions remain favorable.

Shareholding Pattern of SBI Bank

SBI’s shareholding pattern reflects strong institutional and government backing:

- Promoters: 57.43%

- Foreign Institutional Investors (FII): 10.28%

- Domestic Institutional Investors (DII): 24.92%

- Public: 7.37%

Factors Influencing SBI Bank Share Price Growth

Credit Growth and Loan Portfolio Strength

An increasing demand for retail and corporate loans is likely to boost SBI’s revenue and profitability, supporting positive share price movement.

Impact of Interest Rate Movements

The Reserve Bank of India’s (RBI) interest rate decisions can influence SBI’s net interest margins (NIM), directly affecting earnings and stock performance.

Government Policies and Economic Reforms

Government initiatives aimed at financial inclusion, infrastructure development, and economic reforms can positively impact SBI’s growth trajectory.

Asset Quality and Non-Performing Assets (NPAs)

Lower NPAs and improved loan recovery mechanisms will enhance investor confidence, potentially boosting share prices.

Digital Transformation and Technological Innovations

SBI’s focus on expanding digital banking, fintech partnerships, and tech-driven services can drive efficiency, improve customer experience, and support long-term growth.

Risks and Challenges Facing SBI Bank in 2025

Rising NPAs and Their Impact

A surge in bad loans could weaken profitability and negatively affect investor sentiment.

Economic Slowdown Risks

An economic downturn could reduce credit demand, potentially leading to lower earnings and share price volatility.

Regulatory Changes and Policy Uncertainties

New banking regulations or changes in government policies could introduce uncertainties for SBI’s operations.

Interest Rate Volatility

Fluctuations in interest rates can affect SBI’s net interest margins and overall profitability.

Competition from Private Banks and Fintech Players

Growing competition from private sector banks and digital financial platforms could pose challenges to SBI’s market share and future growth.

Read More: ICICI Securities Reaffirms BUY Rating on LIC: Target Price Set at ₹1,040 with 37% Upside Potential

Conclusion

The State Bank of India remains a robust investment choice for 2025, backed by strong fundamentals, government support, and a focus on digital innovation. While certain risks persist, the bank’s growth potential looks promising, with share prices potentially reaching ₹920 by the end of the year. Investors should stay informed on market trends and economic developments to make strategic investment decisions.

Pingback: Share Market Update - RIL Share Price Target 2025 - Prestigerate.com