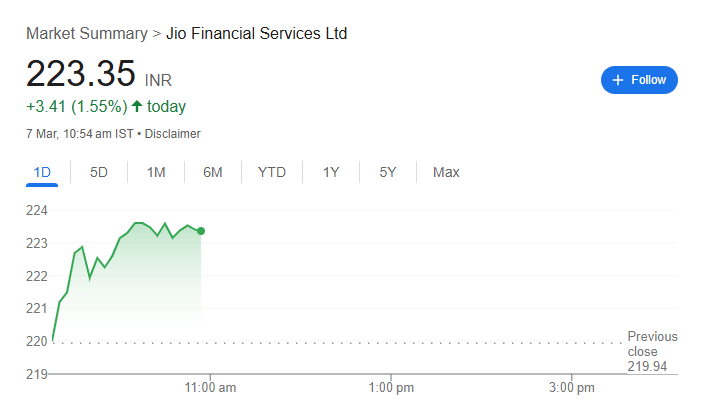

Jio Finance Share Price Target 2025,2030,2040,2050,2060:- Jio Finance has emerged as a significant player in the financial sector, leveraging the digital revolution and Reliance’s extensive network. Investors are keen to understand its long-term growth potential. Here, we analyze Jio Finance’s share price target from 2025 to 2060, Checking key growth drivers, market trends, and expert predictions. Jio Finance Share Price Target As on NSE on 7, March 2025 is 223.22

Jio Finance Share Price Target: Current Market Overview

- Open Price: ₹220

- Day’s High: ₹223.79

- Day’s Low: ₹218.79

- Market Capitalization: ₹ 1.42L crore

- P/E Ratio: 88.22

- Dividend Yield: NA

- 52-Week High: ₹394.70

- 52-Week Low: ₹198.20

Jio Finance Share Price Target: Share Holding Pattern

- Promoters: 47.1%

- Foreign Institutional Investors (FIIs): 15.6%

- Domestic Institutional Investors (DIIs): 12.6%

- Public & Retail Investors: 24.6%

- Others: 0.0%

Jio Finance Share Price Target: Current Market Charts

Jio Finance Share Price Target 2025 Prediction

| Jio Finance Share Prices Target Years | Jio Finance Share Price Target Month | Share Price Target |

| Jio Finance Share Prices Target 2025 | March | ₹225 |

| Jio Finance Share Prices Target 2025 | April | ₹230 |

| Jio Finance Share Prices Target 2025 | May | ₹240 |

| Jio Finance Share Prices Target 2025 | June | ₹250 |

| Jio Finance Share Prices Target 2025 | July | ₹270 |

| Jio Finance Share Prices Target 2025 | August | ₹290 |

| Jio Finance Share Prices Target 2025 | September | ₹310 |

| Jio Finance Share Prices Target 2025 | October | ₹320 |

| Jio Finance Share Prices Target 2025 | November | ₹340 |

| Jio Finance Share Prices Target 2025 | December | ₹350 |

Jio Finance Share Prices Target 2025:- Key Factors Affecting Growth

1. Digital Financial Revolution

Jio Finance’s Role play in digital payments and lending digital services across the globe and expansion of fintech services

2. Reliance Group’s Market Influence

- Backing by Reliance Industries Ltd (RIL)

- Strong infrastructure and customer base

3. Government Policies & Regulations

- RBI policies on digital banking

- Financial inclusion initiatives

4. Competition & Market Positioning

- Competitors like Paytm, Bajaj Finance, and traditional banks

- Unique value proposition of Jio Finance

5. Technological Advancements

- AI-driven credit assessment

- Blockchain & secure digital transactions

Read More: Share Market News: Tata Motors share price target 2025, 2030, 2040, 2050, 2060

Jio Finance Share Prices Target 2030

| Year | Minimum Target Price | Maximum Target Price |

| Jio Finance Share Price Target 2030 | ₹6,00 | ₹8,00 |

Jio Finance Share Price Target 2030 Growth Facrors is a Wider customer base, fintech innovation

Jio Finance Share Prices Target 2040

| Year | Minimum Target Price | Maximum Target Price |

| Jio Finance Share Price Target 2040 | ₹1,500 | ₹2,000 |

Jio Finance Share Price Target 2040 Growth Factors Is Market dominance and international expansion.

Jio Finance Share Prices Target 2050

| Year | Minimum Target Price | Maximum Target Price |

| Jio Finance Share Prices Target 2050 | ₹4,000 | ₹5,500 |

Jio Finance Share Prices Target 2050 Growth Factors is AI-driven financial services, a strong global presence.

Jio Finance Share Price Target 2060

| Year | Minimum Target Price | Maximum Target Price |

| Jio Finance Share Price Target 2060 | ₹10,000 | ₹12,500 |

Jio Finance Share Price Target 2060 Growth Factors is Leading global financial institution status.

FAQ

1. Is Jio Finance a good stock for long-term investment?

Yes, given its backing by Reliance and growth in fintech, Jio Finance has strong potential for long-term investors.

2. What are the risks of investing in Jio Finance?

Regulatory changes, competition, and economic downturns are key risks.

3. Will Jio Finance expand internationally?

While there is no official confirmation, given its digital nature, international expansion is a strong possibility in the long run.

4. How does Jio Finance compare with other fintech companies?

Jio Finance benefits from Reliance’s vast customer base and infrastructure, making it a formidable competitor in the fintech space.

Conclusion

Jio Finance possesses strong growth potential in the fintech space. With Reliance’s backing, cutting-edge technology, and government support, its stock could be a lucrative investment for the future. Investors should keep an eye on market trends and regulatory developments.

Pingback: Why India Is A Stronger Long-Term Investment Than China - Ashmore Group CEO Mark Coombs Say » Prestigerate.com